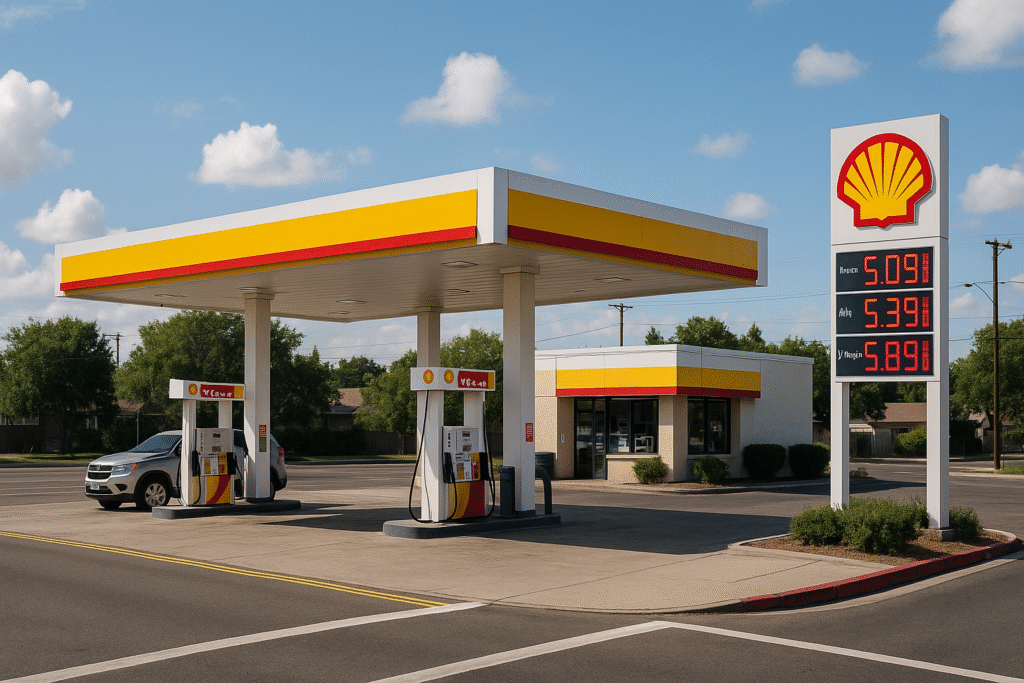

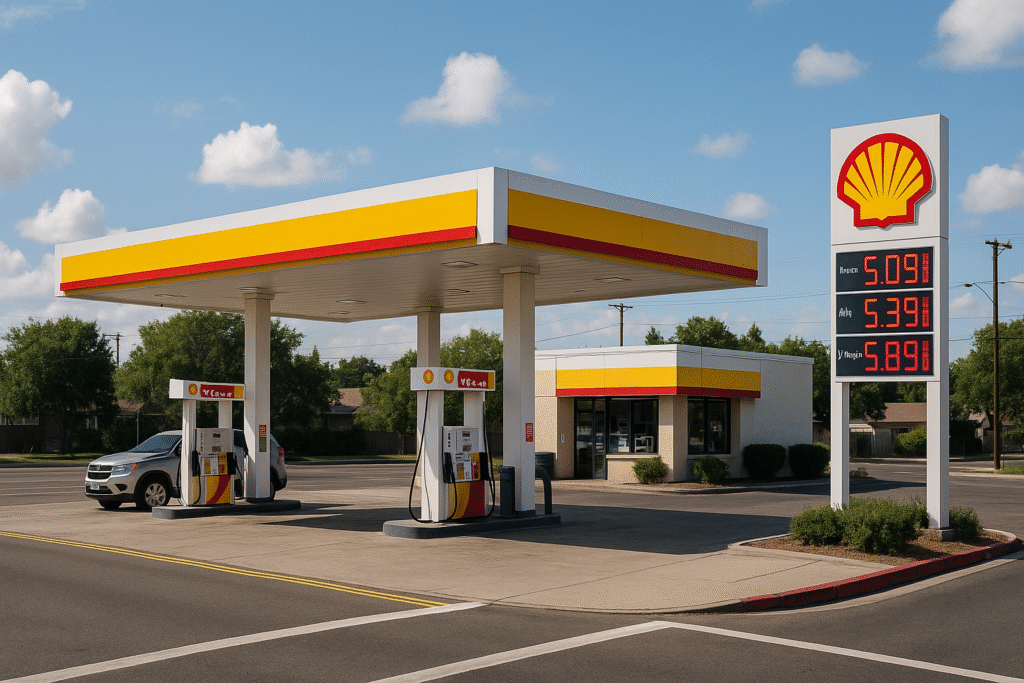

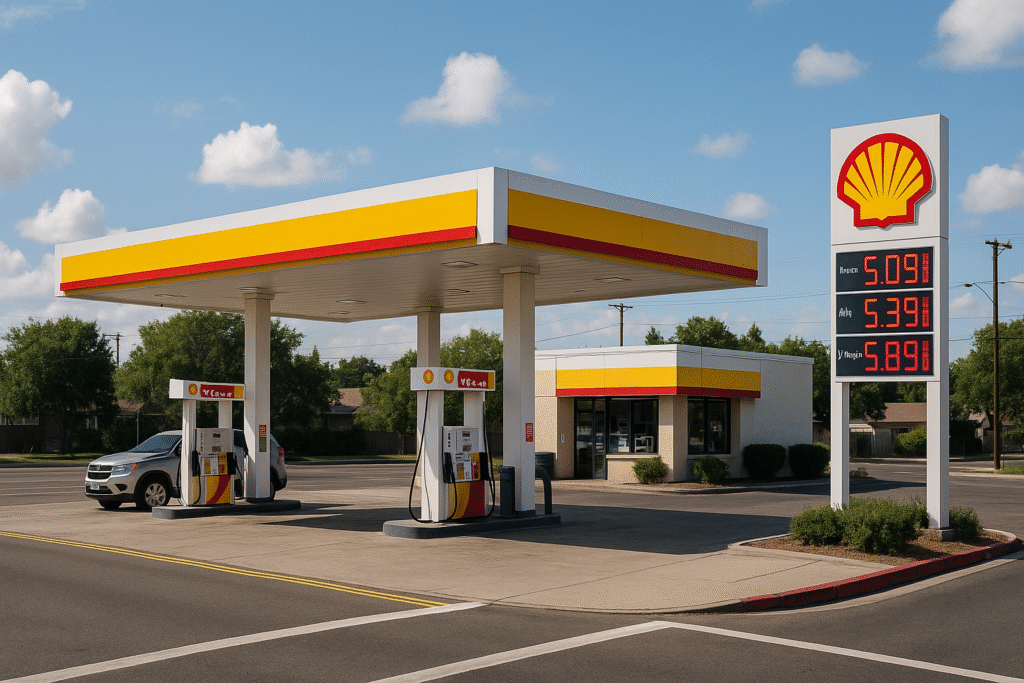

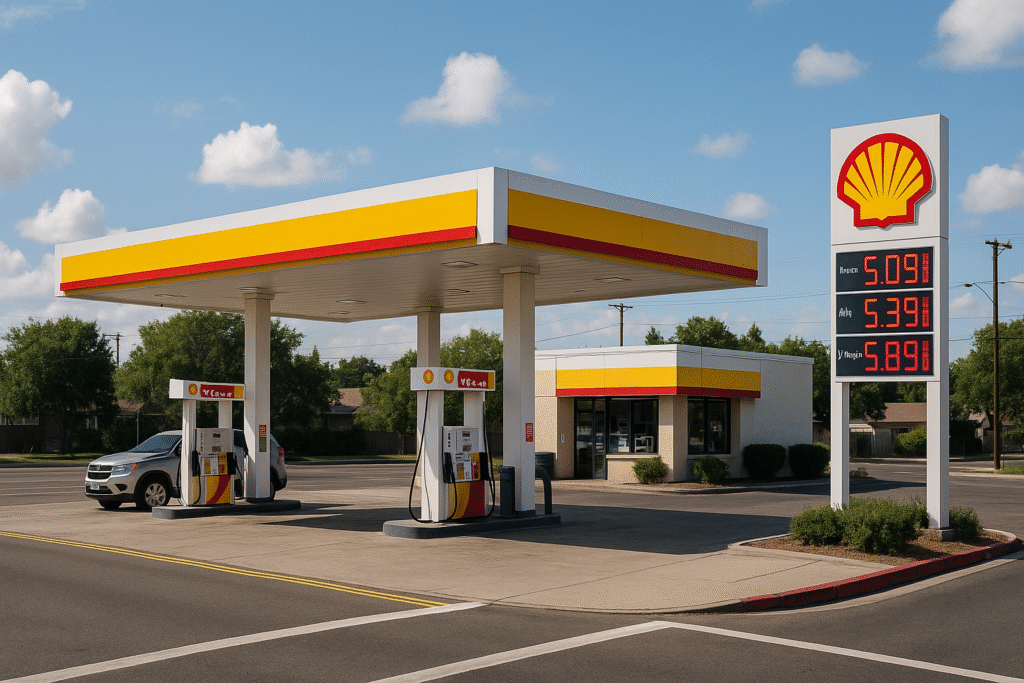

NNN Shell Gas Station for Sale

Shell—also known as Royal Dutch Shell PLC—is a global energy giant headquartered in the Netherlands and incorporated in England. In the United States, Shell operates through its subsidiary, Shell Oil Company, based in Houston, Texas. With over 80,000 U.S. employees and a network of more than 12,000 gas stations, Shell is not only one of the largest oil and gas producers in the country but also one of the most sought-after triple net (NNN) real estate investments in the commercial real estate market.

For investors looking for stable, passive income and long-term value, Shell NNN leased properties offer an attractive opportunity.

"*" indicates required fields

Shell Lease Structure and Types of Net Leases Shell Uses

Shell gas stations generally operate under 20-year NNN leases, with 10% rent escalations every five years. Most of Shell’s triple net lease properties are structured this way, making them ideal for long-term investors seeking predictable cash flow and minimal landlord responsibilities.

However, older Shell locations may operate under NN leases, where the tenant covers taxes and insurance, but the landlord retains responsibility for structural repairs and roof maintenance. While this investment opportunity can offer slightly higher cap rates, it comes with more landlord obligations.

Shell NNN Property Overview

CategoryTypical Value

- Average Sale Price: $2,000,000

- Average NOI: $180,000 annually

- Average Cap Rate: 5.75%

- Average Square Footage: 3,000

- SFLot Size: 0.5 to 1.0 acres

- Typical Lease Term: 20 years

- Rent Escalators: 10% every 5 years

- Preferred Locations: Prime locations; high-traffic intersections

Shell focuses on high-visibility corner sites, typically with traffic signals, convenient ingress/egress, and ample parking. These locations are often outparcels to shopping centers, near C-stores like Circle K and 7-Eleven, fast-food restaurants like Burger King or even near other gas stations like Chevron. The strict site selection process helps preserve property value and attract consistent foot traffic.

How Much Does It Cost to Buy a Shell Gas Station?

Buying a Shell gas station can vary significantly depending on location, size, fuel volume, and whether it includes a convenience store. However, most Shell NNN gas station properties fall between $1.5 million and $3 million, with cap rates ranging from 5.25% to 6.25%, depending on the lease terms and tenant strength.

Keep in mind:

- Franchise-owned Shell stations (non-corporate guaranteed) may cost less but come with more risk.

- Corporate-backed NNN leases are priced at a premium but offer strong financial security and long-term stability.

How Much Do Gas Station Owners Earn?

Earnings for gas station owners can vary greatly depending on:

- Fuel margins (which are typically thin—around 10 to 15 cents per gallon)

- Convenience store sales (which offer higher profit margins)

- Lease structure (corporate vs. franchise)

- Additional income streams (e.g., car wash, ATM fees, food service)

For NNN investors, the concern isn’t operational profit, but net operating income (NOI) from the lease. A typical Shell NNN investor can expect to earn around $180,000 in annual NOI on a $2 million property—translating to a 5.75% cap rate.

Why Shell Is a High-Quality NNN Tenant

Shell offers more than just fuel—it offers stability. With a longstanding brand, corporate credit guarantee, and strong real estate fundamentals, Shell is considered an investment-grade tenant. Here’s why:

- S&P Credit Rating: A+

- FY 2022 Revenue: $386 billion

- FY 2022 Gross Profit: $83 billion (up 56% from 2018)

- 12,000+ U.S. Locations

Following a dip in 2020 due to COVID-19, Shell bounced back with one of its strongest fiscal performances ever. This strong rebound demonstrates resilience, excellent management, and a continued commitment to long-term profitability.

Evaluating a Shell NNN Lease Investment

When considering a Shell NNN property, focus on:

Location quality (visibility, traffic count, access)

Lease terms (remaining lease duration, escalators)

Tenant strength (corporate vs. franchise guarantee)

Exit strategy (liquidity and resale demand)

Since Shell stations are often single-tenant properties, vacancy risk is binary—either fully occupied or generating no income. Therefore, the initial due diligence is crucial.

With gross leases, landlords shoulder all the operating costs—taxes, insurance, and maintenance. That creates more volatility and overhead for investors.

Net leases, especially NNN leases, offer:

Predictable income

Lower risk

Hands-off property management

Strong tenant accountability

For high-net-worth investors, retirees, or 1031 exchange buyers looking for long-term passive income, net leases are the gold standard.

Conclusion

If you’re seeking a reliable, passive income stream backed by a global brand, Shell NNN properties are hard to beat. With long-term leases, minimal landlord duties, and strong tenant credit, Shell stations offer solid performance in both stable and uncertain markets.

Just remember:

- Invest in locations that Shell itself would choose

- Prioritize corporate-backed leases

- Evaluate cap rate vs. risk based on lease type (NN vs. NNN)

- Work with professionals to uncover high-quality deals

Whether you’re a seasoned investor or just entering the NNN world, Shell gas stations offer consistent income, peace of mind, and long-term value.

Questions about NNN Properties for Sale?

Predictable, long-term income

Minimal landlord responsibilities

A globally recognized tenant with strong demand

Alignment with 1031 exchange strategies

These assets combine brand strength, real estate quality, and lease durability.